GST PRACTITIONERS ENROLMENT CONFIRMATION EXAMINATION RESULTS FOR EXAMINATION HELD ON 12.12.2019

The Goods and Services Tax Act, 2017 came into force in India

The GST Practitioners Enrolment Confirmation Examinations

were held on the following dates

1st Batch Examination 31.10.2018

2nd

Batch Examination 17.12.2018

3rd

Batch Examination 14.06.2019

National

Academy of Customs, Indirect Taxes and Narcotics (NACIN) has conducted examination

for confirmation of enrolment of Goods and Services Tax Practitioners (GSTPs)

in terms of second proviso to sub-rule (3) of the Central Goods and Services

Tax Act Rules, 2017. The examination was held on 12.12.2019 at eighteen centers

across India

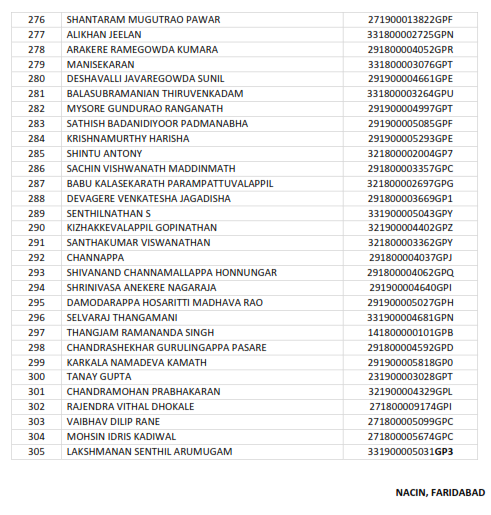

The

Result of the above mentioned examination including marks obtained has been

made available individually to all GST Practitioners who had appeared in the

examination through emails and also on the Examination Portal as Candidates’

dashboard.

The declaration

of result of examination published by NACIN is given below for ready reference:

PLEASE CLICK THE LINK GIVEN BELOW TO VIEW THE RESULTS DIRECTLY:

http://www.cbic.gov.in/resources//htdocs-cbec/deptt_offcr/Result_1212.pdf

PLEASE CLICK THE LINK GIVEN BELOW TO VIEW THE RESULTS DIRECTLY:

http://www.cbic.gov.in/resources//htdocs-cbec/deptt_offcr/Result_1212.pdf