OPTIONAL FORM GSTR-9 (BELOW 2 CRORES) AND FORM GSTR-9A TO BE FILED WITHIN THE EXTENDED DUE DATES

The Goods and Services Tax Act, 2017 came

into force with effect from 1.7.2017 in India.

Under Section 44

(1) of the Central Goods and Services Tax Act, 2017, every taxpayer, other than

an Input Service Distributor, a person paying tax under Section 51 or Section

52, a casual taxable person and a non-resident taxable person shall furnish FORM

GSTR-9 and FORM GSTR-9A and FORM GSTR-9C electronically before 31st December

of the succeeding financial year.

The time limit

to file Annual Returns in FORM GSTR-9, FORM GSTR-9A and FORM GSTR-9C for the

year 2017-18 has been extended from 31.12.2018 to 31.3.2019, 30.6.2019,

31.8.2019, 30.11.2019 and finally extended upto 31.12.2019.

The time limit

to file Annual Returns in FORM GSTR-9, FORM GSTR-9A and FORM GSTR-9C for the

year 2018-19 have been extended from 31.12.2019 to 31.3.2020.

The GST Council,

in its 37th meeting recommended relaxation in filing of annual

returns for MSMEs for Financial year 2017-18 and Financial year 2018-19 as

under:

· Waiver of requirement of filing

FORM GSTR-9A for composition taxpayers for the said periods; and

· Filing of FORM GSTR-9 for those

taxpayers who (are required to file the said return but) have aggregate

turnover up to Rs. 2 Crores made optional for the said tax periods.

CERTAIN PRACTICAL DIFFICULTIES EXPERIENCED IN FILING ANNUAL RETURNS

The suppliers

uploaded FORM GSTR-1 without correct alpha-numeric GSTIN which were not

accepted by the GST Portal and hence the taxpayers disclosed such supplies

under B2C instead of B2B. Such transactions were not auto-populated in the

Recipient’s inward supply details. Opportunity to correct such mistakes was not

utilized by such taxpayers within the stipulated time.

Similarly

suppliers have uploaded all supplies details in the GST Portal. The supplies may relate to business

activities or capital goods or consumables or goods or services for own use

etc. In such cases the Input Tax Credit

auto-populated may be higher than the eligible Input Tax Credit and

such ITC has to be reversed in relevant columns.

Amendments made

by the Suppliers were not considered by the Recipients and in certain cases

there are some variations in auto-populated Input Tax Credit.

The late

migrated taxpayers were allowed to file FORM GSTR-3B and FORM GSTR-1 without

any late fee or interest between 22.12.2018 to 31.3.2019 which were not

auto-populated in recipient’s FORM GSTR-9 or FORM GSTR-9A in certain cases,

Credit Notes or

Debit Notes were not properly accounted for by the taxpayers.

Some taxpayers

have disclosed NIL rated supplies (exempted) under Zero rated supplies (Export

or SEZ) and vice-versa by mistake and Non-GST supplies were not reported.

Reverse Charge

Mechanism applicability were not reported by some taxpayers and there is short

payment of tax.

If there are

omissions in supplies details and omission in reporting Reverse Charge

Mechanism turnover already furnished the same may be rectified in the Simplified

Annual Return and difference of tax payable may be paid through FORM GST DRC-3 only..

Correct inward

supply details may be furnished separately in PDF format duly signed by the

taxpayer without CA approval if necessary.

BENEFITS OF FILING OF OPTIONAL ANNUAL RETURN

The suppliers of

Goods or Services or both whose aggregate turnover is above Rs. 2 Crore will

certainly furnish Annual Returns.

Cross

verification of supplies of suppliers with the inward supplies of Recipients

will result in difference of turnover.

Similarly inward supplies of recipients with the outward supplies of the

suppliers will result in difference of turnover.

If the

difference of non-disclosure of supply or inward supply or non-payment of tax

on Reverse Charge Mechanism is noticed by the Department, the assessing

authority will raise additional demand with late fee, interest and also

penalty.

To avoid such additional demand if any with penalty, all taxpayers whose aggregate turnover

below Rs.2 Crore may file Annual returns and verify the correctness.

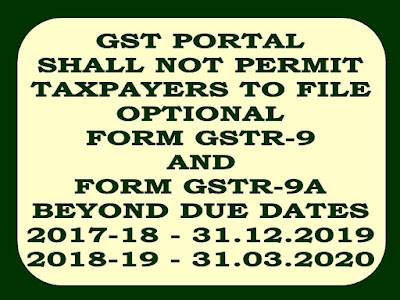

The time limit

to file optional Annual Returns were prescribed as shown below:

FORM TYPE

|

YEAR

|

EXTENDED DUE DATE

|

FORM GSTR-9

|

2017-18

2018-19

|

31.12.2019

31.03.2020

|

FORM GSTR-9A

|

2017-18

2018-19

|

31.12.2019

31.03.2020

|

As there is no

provision to levy late fee on optional annual returns, the GST Portal will not

accept the same beyond the extended due date mentioned above.

The Government of India issued Circular No. CBEC-20/16.05.18-GST dated 18.11.2019 and clarified that

The Government of India issued Circular No. CBEC-20/16.05.18-GST dated 18.11.2019 and clarified that

· As per proviso

to sub-rule (1) of rule 80 of the CGST Rules, a person paying tax under

section 10 is required to furnish the annual return in FORM GSTR-9A. Since the said notification has made it optional to furnish the annual return

for FY 2017-18 and 2018-19 for those registered persons whose aggregate turnover in a financial year does not exceed two

crore rupees, it is clarified that the tax payers under composition scheme, may, at their

own option file FORM GSTR-9A for the said financial years before the due date.

After the due date of furnishing the annual return

for the year 2017-18 and 2018-19, the common portal shall not permit furnishing of FORM GSTR-9A for the said period.

· As per sub-rule (1) of rule 80 of the CGST Rules, every registered person other than an Input Service Distributor,

a person paying tax under section 51 or section 52, a casual

taxable person and a non-resident

taxable person, shall furnish an annual return as specified under

sub-section (1) of section 44 electronically in FORM

GSTR-9. Further, the said

notification has made it optional

to furnish the annual return for FY 2017-18 and 2018-19 for those registered persons whose aggregate turnover in a financial year does not exceed two

crore rupees. Accordingly, it is clarified that the tax payers, may, at their own option

file FORM GSTR-9 for the said financial years before the due date.

After the due date of furnishing the

annual return for the year 2017-18 and 2018-19, the common portal shall not

permit furnishing of FORM GSTR-9 for the said period.

Section 73 of the said Act provides for voluntary payment of tax dues by the taxpayers at

any point in time. Therefore, irrespective of

the time and quantum of tax which has not been paid

or short paid, the taxpayer has the liberty to self-ascertain

such tax amount and pay it through FORM GST DRC-03. Accordingly, it is clarified that if any registered tax payer, during course of reconciliation of his accounts,

notices any short payment of tax or ineligible availment of input

tax credit, he may pay the same through FORM GST DRC-03.

It is better to file optional GST Annual returns as early as possible to avoid additional demand with penalty.

It is better to file optional GST Annual returns as early as possible to avoid additional demand with penalty.

The relevant circular issued is given below for

ready reference:

CBEC-20/16/04/18-GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

GST Policy Wing

****

To,

New Delhi,

Dated the 18th November, 2019

The Principal Chief Commissioners/Chief Commissioners/Principal Commissioners/ Commissioners of Central Tax (All) / The Principal Director Generals/

Director Generals (All)

Madam/Sir,

Sub: Clarification

regarding optional filing of annual return under

notification

No. 47/2019- Central Tax dated 9th October, 2019 - regarding

Attention is invited

to notification No. 47/2019-Central Tax dated 9th October, 2019

(hereinafter referred to as “the said notification”)

issued under section 148 of the Central Goods

and Services Tax Act, 2017 (hereinafter referred to as “the said Act”) providing for special procedure for those registered persons whose aggregate

turnover in a financial year does not

exceed two crore rupees and who have not furnished the annual return under sub-section (1) of section 44 of the said Act read with sub-rule (1) of

rule 80 of the Central

Goods and Services Tax

Rules, 2017 (hereinafter referred to as “the CGST Rules”).

2. Vide the said notification it

is provided that the annual return shall be deemed to be furnished on the due date if it has not been furnished before the due date for the financial year 2017-18 and 2018-19, in respect of those registered persons. In order to clarify the issue and to ensure uniformity in the implementation of the provisions of the law across field formations, the Board, in exercise of its powers conferred by section 168 (1) of the said Act, hereby clarifies the

issues raised as below:–

a. As per proviso to

sub-rule (1) of rule 80 of the CGST Rules, a person paying tax under section 10 is required to furnish the annual return in FORM GSTR-9A. Since the said notification has made it optional to furnish the annual return

for FY 2017-18 and 2018-19 for those registered persons whose aggregate turnover in a financial year does not exceed two

crore rupees, it is clarified that the tax payers under composition scheme, may, at their

own option file FORM GSTR-9A for the said financial years before the due date.

After the due date of furnishing the annual return

for the year 2017-18 and 2018-19, the common portal shall not permit furnishing of FORM GSTR-9A for the said period.

b. As per sub-rule (1) of rule 80 of the CGST Rules, every registered person other than an Input Service Distributor,

a person paying tax under section 51 or section 52, a casual

taxable person and a non-resident

taxable person, shall furnish an annual return as specified under sub-section (1) of section 44 electronically in FORM GSTR-9.

Further, the said

notification has made it optional

to furnish the annual return for FY 2017-18 and 2018-19 for those registered persons whose aggregate turnover in a financial year does not exceed two

crore rupees. Accordingly, it is clarified that the tax payers, may, at their own option

file FORM GSTR-9 for the said financial years before the due date.

After the due date of furnishing the

annual return for the year 2017-18 and 2018-19, the common portal shall not

permit furnishing of FORM GSTR-9 for the said period.

3. Section 73 of the said Act provides for voluntary payment of tax dues by the taxpayers at

any point in time. Therefore, irrespective of

the time and quantum of tax which has not been paid

or short paid, the taxpayer has the liberty to self-ascertain

such tax amount and pay it through FORM GST DRC-03. Accordingly, it is clarified that if any registered tax payer, during course of reconciliation of his accounts,

notices any short payment of tax or ineligible availment of input

tax credit, he may pay the same through FORM GST DRC-03.

4. Difficulty if any, in the implementation of this circular may be brought to the notice of the

Board. Hindi version would follow.

*****

(Yogendra Garg) Principal Commissioner y.garg@nic.in