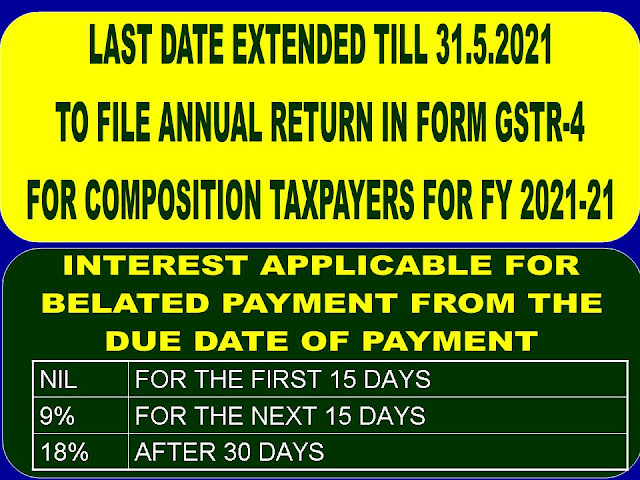

LAST DATE EXTENDED TILL 31.5.2021 TO FILE ANNUAL RETURN IN FORM GSTR-4 FOR COMPOSITION OPTED TAXPAYERS FOR FY 2021-21.

The Goods and Services Tax Act, 2017 came into force with effect from

1.7.2017 in India.

The Composition opted persons were paying taxes and filing their

returns as shown below:

|

2020-2021 |

||

|

PERIOD |

RETURN TYPE |

DUE DATE |

|

APR-JUN |

FORM GST CMP-08 |

18.07.2020 |

|

JUL-SEP |

FORM GST CMP-08 |

18.10.2020 |

|

OCT-DEC |

FORM GST CMP-08 |

18.01.2021 |

|

JAN-MAR |

FORM GST CMP-08 |

18.04.2021 |

|

APR 2020 TO MAR 2021 ANNUAL

RETURN |

FORM GSTR-4 |

30.04.2021 |

The composition opted persons were paying GST on quarterly basis

through FORM GST CMP-08.

The Central Government has extended the last date to file Annual GST

Return in FORM GSTR-4 for composition opted persons from 30.4.2021 to 31.5.2021

due to outbreak of second wave of COVID-19 as per Notification No. 10/2021-Central

Tax dated 1.5.2021.

The Central Government has also announced concessional rates of

interest for registered persons who opted to pay tax under composition scheme

at “NIL” rate of interest for the first 15 days from the due date of payment of

tax and at 9% for the for the next 15 days, and at 18% thereafter for the

quarter ended 31.3.2021 vide Notification No.8/2021 Central Tax, dated

1.5.2021.

The relevant Notifications are given below for ready reference:

[To be published in the

Gazette of India, Extraordinary, Part II, Section 3,

Sub-

section (i)]

Government of India Ministry

of Finance (Department of Revenue)

Central

Board of Indirect Taxes

and

Customs

Notification No. 10/2021 – Central

Tax

New Delhi, the 1st May, 2021

G.S.R.....(E).— In exercise of the powers conferred by section 148 of the Central

Goods and Services Tax Act,

2017 (12 of 2017), the Government, on the recommendations of the Council, hereby makes the following

further amendments in

the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 21/2019- Central Tax, dated the 23rd April, 2019, published in the

Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.

322(E),

dated the 23rd April, 2019, namely:–

In the said notification, in the

third paragraph, after

the first proviso, the following

proviso shall be inserted, namely: –

“Provided further that the said persons shall furnish the return in FORM GSTR-4 of the Central Goods and Services Tax Rules, 2017, for

the financial year

ending 31st March, 2021,

upto the 31st day of

May,

2021.”.

2. This notification shall be deemed to have come into force with effect from the 30th

day of April,

2021.

[F. No. CBEC-20/06/08/2020-GST]

(Rajeev Ranjan)

Under Secretary to

the

Government of India

Note: The principal notification No. 21/2019- Central Tax, dated the 23rd April, 2019, was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section

(i) vide number G.S.R. 322(E), dated the 23rd April, 2019 and was last amended by notification No. 64/2020-Central Tax, dated the 31st August, 2020, published in the

Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.

539(E), dated

the 31st August, 2020.

[To be published in the

Gazette of India, Extraordinary, Part II, Section 3,

Sub-

section (i)]

Government of India Ministry

of Finance (Department of Revenue)

Central

Board of Indirect Taxes

and

Customs

Notification No. 08/2021 – Central

Tax

New Delhi,

the 1st May, 2021

G.S.R.....(E).- In exercise of the powers conferred by

sub-section (1) of section 50 of the Central Goods and Services Tax Act, 2017 (12 of

2017) read with section 148 of the said Act, the Government, on the recommendations of the Council, hereby makes the following further amendments

in notification of

the Government of India

in the Ministry of Finance (Department of Revenue), No. 13/2017

– Central Tax, dated the

28th June, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3,

Sub-section (i)

vide number G.S.R. 661(E), dated the 28th June, 2017, namely:–

(i) In the said notification, in the first paragraph, in the first proviso,

in the Table after S. No. 3, the following shall be inserted, namely: –

|

(1) |

(2) |

(3) |

(4) |

|

“4. |

Taxpayers

having

an aggregate

turnover

of more

than

rupees

5

crores

in

the

preceding financial year |

9 per cent

for the first 15 days

from the due date and 18 per cent

thereafter |

March, 2021, April,

2021 |

|

5. |

Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial

year who are liable to furnish

the return as specified under

sub-section (1)

of section 39 |

Nil for the first 15 days from the

due date, 9 per cent for the next 15 days, and 18 |

March, 2021, April,

2021 |

|

|

|

per cent thereafter |

|

|

6. |

Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial

year who are liable to furnish

the return as specified under proviso to sub-section

(1) of section 39 |

Nil for the first 15 days from the

due date, 9 per cent for the next 15 days, and

18 per cent thereafter |

March, 2021, April,

2021 |

|

7. |

Taxpayers who are liable to furnish

the return as specified under sub-section

(2) of section

39 |

Nil for the first 15 days from the

due date, 9 per cent for the next 15 days, and

18 per cent thereafter |

Quarter ending March, 2021.”. |

2. This notification shall be deemed to have come into force with effect from the 18th

day of April,

2021.

[F.

No. CBEC-20/06/08/2020-GST]

(Rajeev Ranjan) Under Secretary to the Government

of India

Note: The principal notification number

13/2017 – Central Tax, dated the 28th June,

2017, was published in the

Gazette

of India,

Extraordinary, Part II, Section 3, Sub-

section (i) vide number

G.S.R. 661(E), dated the 28th June, 2017 and was

last amended vide notification number 51/2020 – Central Tax, dated the 24th June, 2020, published

in the Gazette

of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 404(E), dated

the 24th June, 2020.

Government of India Ministry

of Finance Department of Revenue

Central Board of Indirect

Taxes & Customs

PRESS RELEASE

New Delhi, 2nd May,

2021

In view of the challenges faced by taxpayers in meeting the statutory and regulatory compliances under

GST law due to the outbreak of

the second wave of COVID-19, the

Government has issued notifications, all dated 1st May, 2021, providing various relief measures

for taxpayers.

These measures are explained

below:

1.Reduction in rate of interest:

Concessional rates of interest in lieu of the normal rate of interest of 18% per annum for delayed tax payments

have

been prescribed in the following

cases-

a. For registered persons having aggregate turnover above Rs. 5 Crore:

A lower rate

of

interest of 9 per cent for the

first 15 days from the

due date

of payment of tax and 18 per

cent thereafter, for

the tax payable for tax periods

March 2021 and April 2021, payable in April 2021 and

May

2021 respectively,

has

been notified.

b. For registered persons having aggregate

turnover upto Rs. 5 Crore: Nil rate of interest for

the first 15 days from the due date of payment of tax,

9 per cent for the next 15 days,

and

18 per cent thereafter, for both

normal taxpayers and those under QRMP scheme, for the

tax payable for the periods March 2021 and April 2021, payable in April 2021 and May

2021

respectively, has been notified.

c. For registered persons who have opted to pay tax under the Composition scheme: NIL rate of interest for first 15 days from the due date of

payment of

tax and 9 per cent for the

next 15 days, and 18 per cent thereafter has been notified for the tax payable for the quarter ending 31st March,

2021, payable

in April 2021.

2.Waiver of late fee

a. For registered persons

having aggregate turnover

above Rs. 5 Crore: Late fee waived

for 15 days in respect of returns in FORM GSTR-3B furnished beyond the due date for tax periods March, 2021 and April, 2021, due in the April 2021 and May 2021 respectively;

b. For registered persons having aggregate turnover

upto

Rs. 5 Crore: Late fee

waived for 30 days in respect of the

returns in FORM GSTR-3B furnished

beyond the due date

for tax periods March, 2021 and April, 2021 (for taxpayers filing monthly returns) due in

April 2021 and May 2021 respectively / and for period Jan-March, 2021 (for taxpayers filing

quarterly returns under QRMP scheme) due in April 2021.

3.

Extension of due date of filing GSTR-1, IFF, GSTR-4

and

ITC-04

a. Due date

of filing FORM GSTR-1 and

IFF for the month

of April (due in May)

has been extended

by

15 days.

b.

Due date of filing FORM GSTR-4 for FY 2020-21 has been extended from 30th April,

2021 to 31st May, 2021.

c. Due date of furnishing FORM ITC-04 for Jan-March, 2021 quarter has been extended

from 25th April, 2021 to

31st May, 2021.

4.

Certain

amendments in CGST

Rules:

a. Relaxation in availment of ITC: Rule 36(4) i.e. 105% cap on availment of ITC in FORM GSTR-3B to be applicable on cumulative basis for period April and May 2021, to be applied

in the return for tax period May 2021. Otherwise, rule 36(4) is applicable

for

each tax period.

b. The filing

of GSTR-3B and GSTR-1/ IFF by companies using electronic verification code has

already been enabled for the period from

the

27.04.2021 to 31.05.2021.

5. Extension in statutory time limits under section 168A of the CGST Act: Time limit for

completion of various actions, by any authority or by any person, under the GST Act, which falls during

the period from 15th April, 2021 to 30th May, 2021, has been extended upto 31st May,

2021, subject

to some exceptions as specified

in the notification.

*****

[This note presents the notifications in simple language for ease of understanding.

For details, please refer to the notifications

issued in this regard,

which shall have force of law.]